What is Ea Form Malaysia

Please select Category and Year then click Search button to see the display. The form will automatically calculate your aggregate income for you.

Understanding Lhdn Form Ea Form E And Form Cp8d

Monthly EPF SOCSO and LHDN Malaysia Payroll reports and Upload Files.

. CP38 deduction or CP38 form is an IRB guideline for employers. Mahsa University provides industry based curriculum with high quality teaching methodology coupled with excellent facilities in Malaysia. Either party can waive the right to a notice.

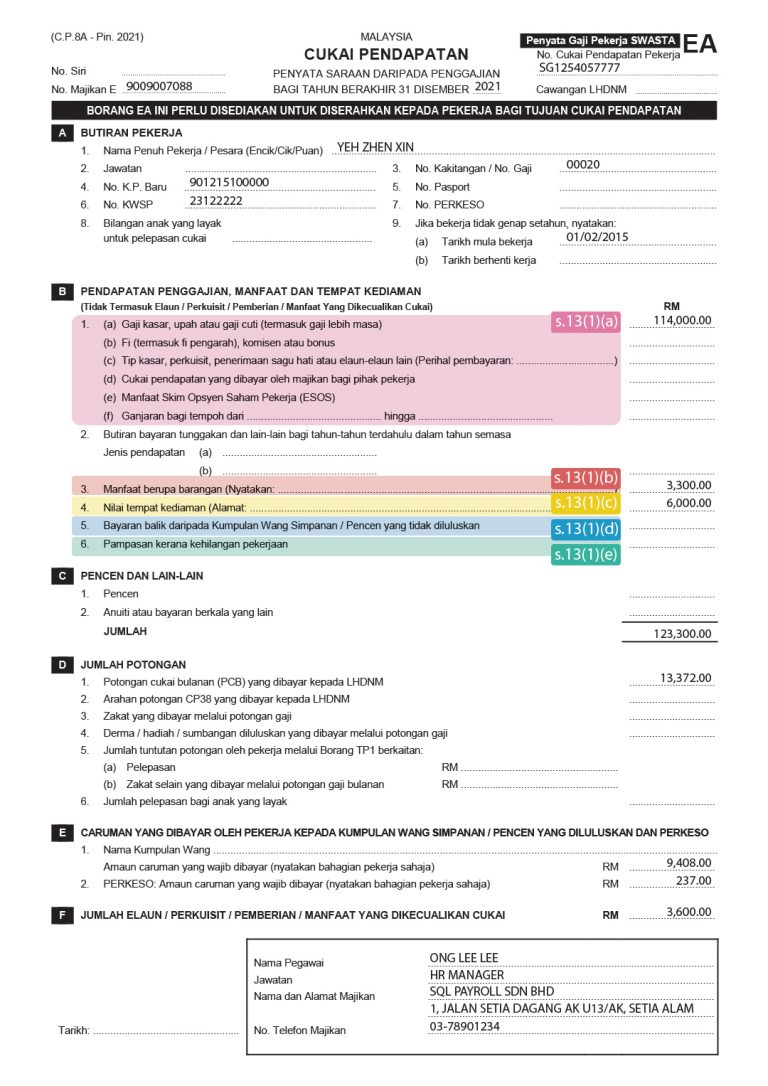

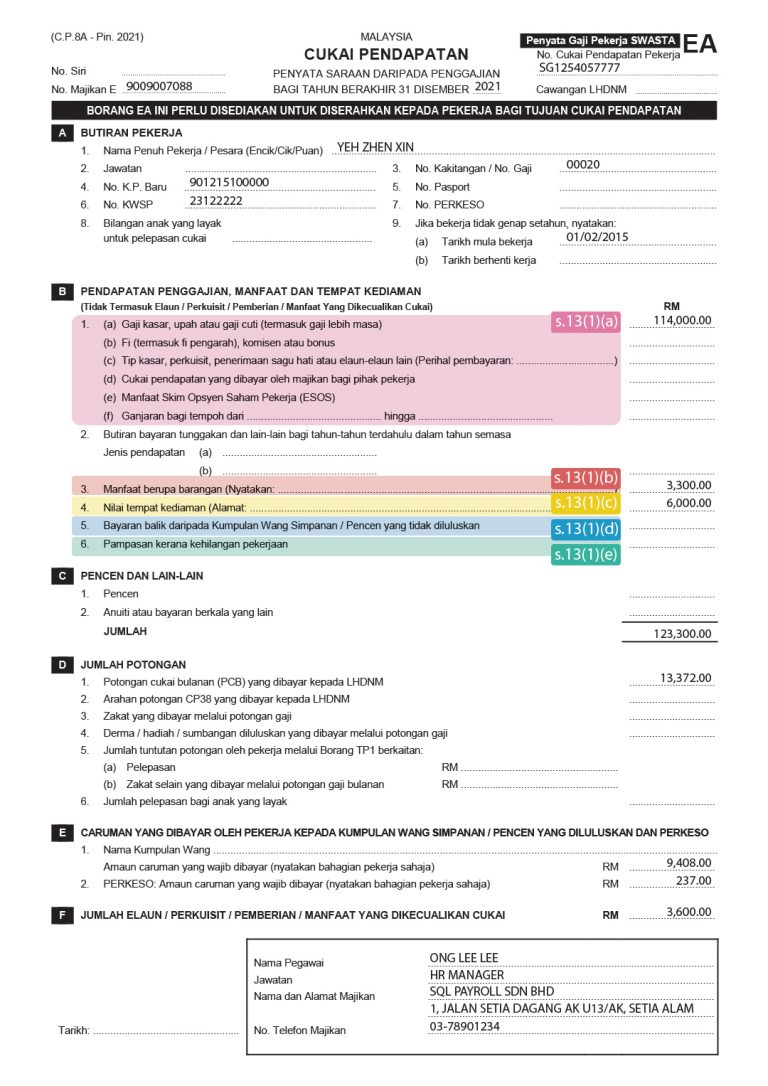

Malaysia is one of the most populous countries in southeast Asia and one of its most prominent economies. The latest version of the EA Form for 2021 is CP8A - Pin. Pine Island Road Suite 320 Plantation FL 33324 USA.

Notes for Part F of Form EA. Download PDF Excel files and guides for EA Form E Form and CP8D in Malay and English. Ateme enables thousands of the worlds leading content owners broadcasters and service providers to captivate their audiences with a superior quality of experience through multi-codec encoding any-format originpackaging scalable cloud DVR audience-aware CDN and revenue-generating dynamic ad insertion solutions.

If you participate in online services such as downloading and. Otherwise a claim will be brought against the employer. Within Malaysia including meals and accomodation for travel not exceeding 3 times in any calendar year.

List of tax exempt allowances perquisites gifts benefits which are required to declare. Malaysia is separated into two landmasses by the South China Sea. The IRB has discovered that you have committed tax fraud.

The notice period is given in the EA applies only if the written contract of service does not contain the notice period. Export Management Reports Payslips and EA Form to PDF and Excel for Customization. The period of 4 weeks.

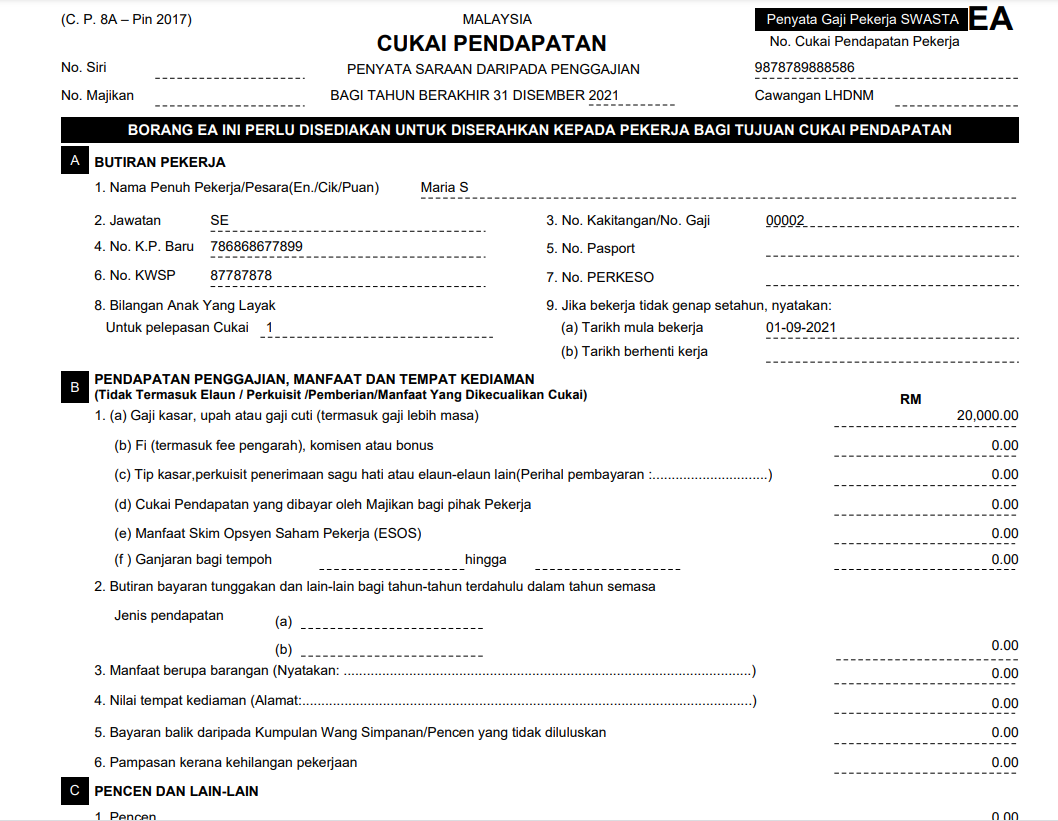

This is where your EA form comes into play as it states your annual income earned from your employer. And employers must follow these instructions. So as an employee you just have to pay.

Edinburgh Business School Students Staff Alumni 中文网 Study Back Study Courses Global College Undergraduate Postgraduate Research Why study at Heriot-Watt. Employees can pay off income tax arrears in installments using the additional CP38 deduction. EA and its affiliates may also use this information in the aggregate in a form which does not personally identify you to improve our products and services and we may share anonymous aggregate data with our third party service providers.

Consent to Public Display of Data. However there are several reasons why you shouldnt accept the annual income stated on your EA form as the final figure for your statutory income from employment. Iii Service provided free.

Our global reach Meet our students Go Global Your career Virtual experience Our rankings International students Study in the UK Academic English Study in your own country Brexit and. Download Form - Other Forms. Download Form - Other Forms.

Or b outside Malaysia not exceeding one passage in any calendar year is limited to a maximum of RM3000. Asia Headquarters 390 Orchard Road 08-01 Palais Renaissance Singapore 238871. 4 weeks notice period 7 days per week x 4 week 28 days.

According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year. Either party can pay the other parth an indemnity amount equal to the wages for the unexpired portion of the notice. The western landmass known as Peninsular Malaysia is bordered to the north by Thailand and to the south by Singapore while the eastern landmass East Malaysia is bordered by Brunei and Indonesia.

The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. According to section 21 Employment Act 1955 the EA as amended via the Employment Amendment Act 2012 a part-time employee means- a a person who has entered into an employment contract or a contract of service with an employer under which such persons wages do not exceed RM2000-00 a month including such person included in the First Schedule of.

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

Form St Partners Plt Chartered Accountants Malaysia Facebook

Comments

Post a Comment